Tabungan Rencana

Tabungan Rencana

OVERVIEW

CPO

CONSTRUCTION

ENERGY

FMCG

METAL MINING

At Bank Mandiri, we are diligently developing and promoting Sustainable Finance practices, including the integration of Environmental, Social & Government (ESG) aspects in our internal business process.

This implementation of Sustainable Finance practices seeks to provide an effective framework for addressing the climate and social risks we are facing so many today.

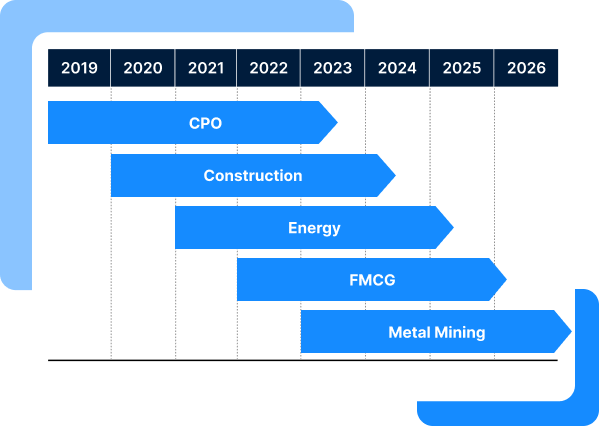

On Practicing Sustainable Finance principles, Bank Mandiri carried out in stages with a focus on ESG integration in 5 priority sectors, namely palm oil and CPO, construction, energy and water, FMCG, and Metal mining.

This integration is carried out by incorporating ESG Aspects in our credit policy that requires minimum criteria such as positive & negative screening of prospective clients' business activities. 5 sector policies are developed in stages by taking into account the specific ESG risk in each sector, and national laws & regulations. This policy is reviewed annually by considering input on environmental and social issues from external and internal stakeholders.

FINANCING POLICY

In addition to the evaluation criteria, we have specific policies and/or Standard Operating Procedures (SOPs) to ensures sustainable practices in our business process:

Bank Mandiri Exclusion List

Prohibit financing project that endanger the environment

Prohibit financing project that endanger the environment

Illegal logging

Illegal logging

Prohibit Peatland Financing

Prohibit Peatland Financing

Prohibit Gambling Business

Prohibit Gambling Business

Prohibit Pornography & Human Right Violations

Prohibit Pornography & Human Right Violations

Prohibit Drugs and Narcotics

Prohibit Drugs and Narcotics

other sectors prohibited by laws and regulations.

other sectors prohibited by laws and regulations.

In identifying and measuring ESG risk, Bank Mandiri has integrated ESG aspects into various Bank policies, such as Standard Credit Procedures that require AMDAL/UKL-UPL/PROPER as well as other criteria in accordance with applicable laws and regulations.

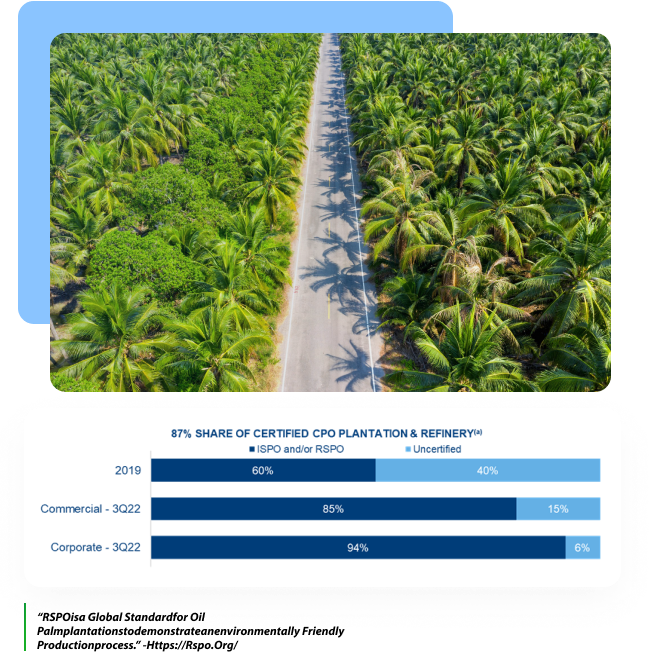

As one of the largest CPO lenders in Indonesia, Bank Mandiri is committed to managing environmental and social risks faced by the CPO sector by ensuring the implementation of sustainable agriculture practices.

Our approach seeks to provide an effective framework for addressing the risk by encouraging, and advising our CPO clients on promoting sustainable practices. we hope to foster the growth of the environmental justice movement so that CPO sector will experience the benefits of a sustainable future.

Through our work in environmental, Bank Mandiri is committed to leading the way toward just sustainability on one of our priority sectors, CPO─ for a better tomorrow and it shows on how do we encourage our CPO debtors to have ISPO/RSPO certifications as you can see the chart on below.

Bank Mandiri is aware of the ongoing risks associated with the CPO sector. Through due diligence and appropriate clients’ management, the Bank will endeavor to manage and reduce these risks.

To balance the economy and environmental & social sustainability in CPO sectors, Bank Mandiri is committed to financing our CPO clients prudently and in accordance with the principles of sustainable agriculture practices.

To promote macroeconomic growth, the Indonesian government has focused on developing national infrastructure over the past few years.

However, in the implementation of infrastructure development, Indonesia faces challenges that can delay the achievement of the goals. The gap between regions in Indonesia is a major obstacle in infrastructure development, especially in the western and eastern regions of Indonesia. The Indonesian government continues to develop various infrastructure policies and programs to achieve national development targets, including increasing connectivity between regions.

The continued growth of this sector also poses risks environmental, social and ethical issues such as noise and air emissions, wastewater, physical, biological and chemical hazards, safety and security risks, habitat change and fragmentation. As a responsible bank, Bank Mandiri is aware of the risks associated with clients’ operations in the Infrastructure Construction Services sector and manages risks through appropriate due diligence and clients’ management. The objective of the Financing & Investment policy for the Infrastructure Construction Services sector is to establish sustainable standards for Infrastructure Construction Services clients.

According to the Association of Southeast Asian Countries, Indonesia is the largest energy user, with a total energy use of nearly 40% among ASEAN members (IRENA, 2017).

Indonesia is one of the countries with the fastest growing energy consumption in the world. The increasing trend of Energy & Water consumption in Indonesia poses environmental, social and government risks. One of the emerging risks is related to energy security, the risk of the energy crisis that is engulfing global economic stability, causing the need for Indonesia to ensure the availability of sustainable energy.

The use of coal, which still dominates domestic energy demand, results in an increase in greenhouse gas emissions resulting from burning coal and thereby exacerbates air pollution and problems related to contamination and water scarcity. However, Indonesia is committed to continuing to promoting energy transitions towards clean energy to achieve the National Net Zero target and support the Paris Agreement commitments. Bank Mandiri as a responsible bank continues to support this energy transition strategy through policy adjustments, conducting due diligence and clients’ engagement.

The food and beverage sector is considered as a major contributor to the Indonesian economy.

The food and beverage industry is under scrutiny for the risks and impacts of poor sustainability practices, in particular with increasing consumer attention to social and environmental impacts. Food safety is considered very important to ensure that the product is in the right condition for consumption, because any violation of food safety regulations can result in the loss of a business operating license permanently or temporarily. Therefore, food safety is considered as an issue that needs to be prioritized. The main environmental problem posed by the food and beverage industry is related to the large amount of waste generated. Another prominent ESG risk in the industry relates to labor conditions. Bank Mandiri is aware of the ongoing risks associated with the food and beverage sector. Through due diligence and appropriate clients’ management, the Bank will endeavor to manage and reduce these risks.

To balance the economy and environmental & social sustainability, Bank Mandiri ensures sustainability practices carried out in each client financed and in accordance with the principles of sustainable practices.

Mineral and Metal Mining provides great economic opportunities for countries with rich natural resources, including Indonesia. Indonesia has a large, and in many cases un prospected, variety of mineral deposits. Mining, including the extraction of Minerals, accounts for roughly one-tenth of the country’s GDP, and through exports and taxation it contributes substantially to foreign-exchange earnings and development.

However, the mining process often poses challenges and risks to the ecosystem. Mining operations at all stages, from exploration to closure mining requires consideration of social and environment impacts. Environmental problems that can be caused by mining operations are the use of hazardous chemicals such as cyanide, tailings disposal, excessive use of water sources and mine closures. Approximately 75% of mine closures leave an environmental impact to the community. Apart from environmental issues, mining operations also raise Social Issues such as the right of local communities and indigenous peoples to have a voice in decision-making about mining projects which is often neglected.

Bank Mandiri is aware of the ongoing risks associated with the Metal Mining sector. Through due diligence and appropriate clients’ management, the Bank will strive to manage and reduce these risks and can support the realization of sustainable mining practices.

Therefore, Bank Mandiri is committed to financing the mining sector prudently and in accordance with the principles of sustainable practices.