Tabungan Rencana

Tabungan Rencana

IMPACT BY NUMBERS

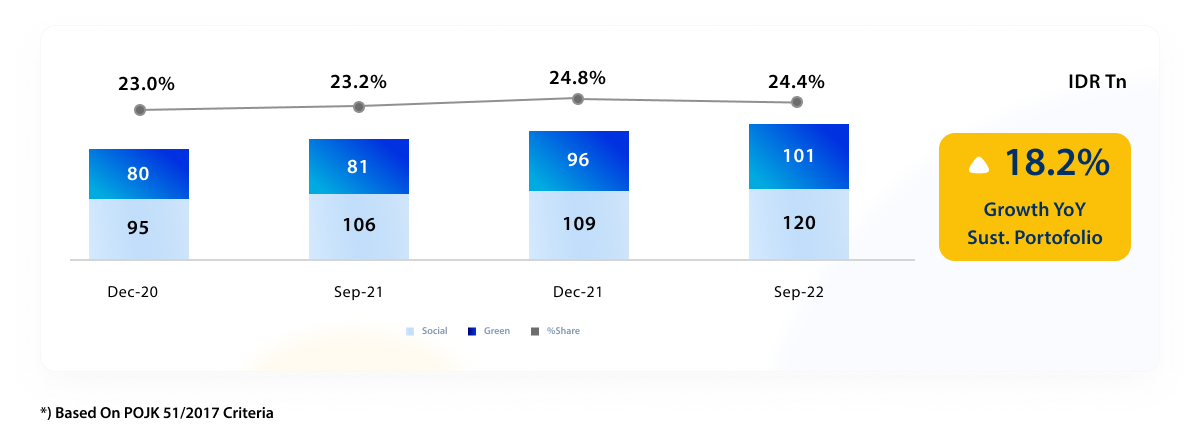

As of September 2022

OUR SUSTAINABLE FINANCING PROJECTS

RENEWABLE ENERGY

CLEAN TRANSPORTATION

POSO HYDRO POWER PLANT

This project is a combination of the existing PLTA Poso (3x65 MW) which has been operating since 2012 and PLTA Poso Extension phase 1 (4x30 MW) and PLTA Poso Extension phase 2 (4x50 MW). The three plants are planned to be operated as Peaker Plants with a total capacity of 515 MW. This Peaker Plant will be operated during peak load times, which are 17.00 to 22.00, with Exclusive Committed Energy of 1,669 GWh per year. PLTA Poso contributes about 10.69% of the total EBT for the Southern Sulawesi electricity system. This environmentally friendly power plant has been interconnected with a 275 kV transmission line to South Sulawesi Province and a 150 kV transmission from the plant to Palu City, Central Sulawesi.

KERINCI HYDRO POWER PLANT

PLTA Merangin utilizes the flow from the Merangin river originating from the Kerinci Lake flow which is planned to be operated as a Peaker Plant with a total capacity of 350 MW. This Peaker Plant will be operated during peak load times, which is 18.00 to 23.00, with Exclusive Commited Energy of 1,280 GWh per year.

LAHAT MINI HYDRO POWER PLANT

The Lahat 9.9 MW PLTM has been in commercial operation on November 28, 2015 and the PPA period will last until November 27, 2035. Based on data obtained from a feasibility study during the construction of the PLTM, the power plant uses the Endikat River water discharge with an area of 284.32 km2 watershed with a river length 41 km and the average annual rainfall is 222.17 mm. Where the average water discharge is 13,217 m3/s with a net head of 89.21 m. Based on these calculations, an installed capacity of 10 MW is obtained.

LIGHT RAIL TRANSIT (LRT) JABODETABEK

As the largest creditor among 12 participating banks, we extend a syndicated loan to KAI to finance its LRT project in 2017. LRT Jabodetabek or The Greater Jakarta LRT which currently under construction is one of the first rapid transit system in Indonesia that integrates the capital city Jakarta to Greater Jakarta’s suburbs Depok, Bogor, and Bekasi

ELECTRIC VEHICLE COMPONENT

In Hongkong, we were Mandated Lead Arrangers for the USD 300 Million Syndicated Green Loan for a client that engaged in research, development, processing, production, and sale of lithium battery cathode material precursors and new energy recycling materials in the fields of new materials and energy. Our client is a partner and supplier of many enterprises ranking among Fortune Global 500.

SUSTAINABILITY BOND

THE BEST SUSTAINABILITY BOND

In April 2021, Bank Mandiri raised USD300 Million in funding from its first Sustainability Bond, which has a 5-year tenor with a coupon of 2.00%. Bond-rating agencies Moody's Investors Services and Fitch Ratings assigned investment-grade ratings to the bond, reflecting high investor confidence in the securities. Investors booked orders of more than $2.5 billion during the bond's book-building process, an oversubscription of more than 8.3 times the planned size. Bank Mandiri's Sustainability Bond has been awarded as the Best Indonesia Sustainability Bond-Financial Institution by The Asset. The proceeds will be used to finance or refinance, in whole or in part, Eligible Sustainability Bond Projects in accordance with certain prescribed eligibility criteria described under the Bank's Sustainability Bond Framework.

SUSTAINABILITY-LINKED LOAN

As one of the first movers in sustainable finance in Indonesia, Bank Mandiri continues to develop and promote sustainable finance practices, including efforts to help achieve a low-carbon economy.

This commitment is shown through Bank Mandiris’ support for clients, especially those who engaged in carbon-intensive sectors, by providing financial solutions that encourage clients to decarbonize and transform their operations into a more responsible, environmentally positive business, with less carbon footprints. One of them is through a Sustainability-Linked Loan.

Sustainability-Linked Loans aim to facilitate and support environmentally and socially sustainable economic activity and growth. Sustainability-Linked Loan is defined as loan instrument that incentivizes the borrower's achievement of ambitious, predetermined sustainability performance objectives.

SUSTAINABLE PRODUCTS FOR THE RETAIL SEGMENT

ELECTRIC VEHICLEY

SOLAR PANEL

“Air pollution is one of the common problems faced in urban areas. UNEP states that as many as 6.5 million people die each year from exposure to poor air quality. In addition, 70% of deaths due to air pollution occur in Asia Pacific, including Indonesia. The transportation sector is the main source of pollution in urban areas. Motor vehicle emissions contribute 70% to the pollution of Nitrogen Oxide (NOx), Carbon Monoxide (CO), Sulfur Dioxide (SO2) and Particulates (PM) in urban areas“.

Ministry of Environment and Forestry

“Solar panels are a great way to offset energy costs, reduce the environmental impact of your home and provide a host of other benefits, such as supporting local businesses and contributing to energy independence. Solar panels also extend the life of a roof, because they protect from the elements, such as rain, snow and debris. They make the house more energy-efficient in the summer because the hot sun is not beating down on the roof directly—it is instead being absorbed by the panels, keeping the house temperature lower.”

US Green Building Council (USGBC)